11.122024

How To Use Fibonacci Retracements

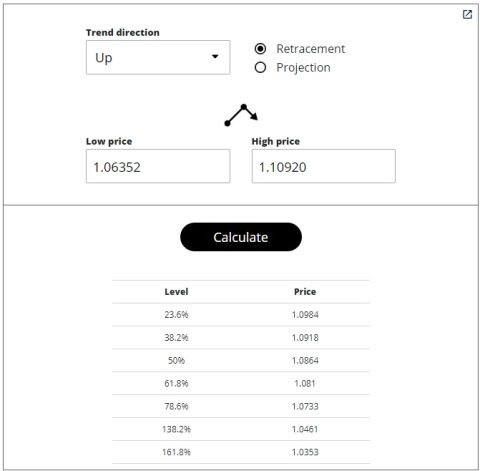

Traders observe whether a worth falls to a degree like 50% or 61.8% and then begins to move in the different way. This strategy is commonly combined with candlestick patterns to strengthen the evaluation. A Fibonacci retracement is a technical evaluation device based mostly on mathematical ratios.

The golden ratio is a mathematical proportion of approximately 1.618, which regularly appears in nature, artwork, and architecture. You Are a swing dealer, however you’re drawing Fibonacci on 15-minute charts. However Fibonacci extensions are even more highly effective for taking profits. Burton Malkiel, in “A Random Walk Down Wall Street,” highlights that many Fibonacci patterns might just be random worth actions. This reinforces the significance of confirming patterns with other tools, as proven in earlier examples. Fibonacci retracements work best in trending markets and ought to be supplemented with different indicators for improved accuracy.

The Vital Thing Fibonacci Ratios

Now the Fibonacci software https://gestionar.com/blockchain-bridges-a-hundred-and-one-how-do-they/ is in place, you’ll find a way to maintain a close eye on those levels to see the place the retracement may run out of steam. Discover the end of a downswing to locate the start of the retracement – the lowest low created by the model new reversal is the beginning of an upswing. All worth motion in forex is made up of upswings adopted by downswings adopted by upswings and vice versa. A swing forms when price rises or falls for some time earlier than transferring in the reverse direction.

After figuring out Fibonacci ranges (23.6%, 38.2%, and sixty one.8%), traders can determine whether to buy or sell that inventory. For instance, if a downtrend starts to go up, they’ll analyze the longer term market trend using the retracement degree forex crm and resolve when to promote an asset to get one of the best value. There is the potential for false signals and breakouts the place the worth briefly respects a Fibonacci degree before persevering with in the reverse direction. This can lead to premature stop-loss triggers and poor commerce execution. If a number of retracement levels are clustered carefully together, prices may react unpredictably, inflicting confusion.

Obtained 25 Minutes? Get Crypto-smart

These levels help traders identify attainable turning factors in worth action. Fibonacci retracement levels are among the go-to instruments for merchants trying to determine potential support and resistance zones throughout pullbacks. The technical indicator is commonly discovered on main on-line brokerage and buying and selling platforms and is rooted within the Fibonacci sequence. These levels help traders spot key price areas where securities may pause, reverse, or proceed trending. In monetary markets, fluctuation in asset prices is normal and happens as impulses and pullbacks. Based Mostly on the direction of worth motion, investors and merchants can make income or suffer losses.

So to mark the retracement ranges correctly, you have to discover the start and end of the swing the retracement is taking place on. The cause why is as a end result of merchants and buyers set larger revenue https://www.xcritical.com/ targets after a sharp motion, (due to the price covering a big distance in a brief amount of time). This means they take much less profit off their trades, which in flip, means price doesn’t appropriate as much during retracements. Usually, you might use support and resistance levels or, in case you have a bit extra experience, supply and demand zones to find the place this retracement could end. By combining Fibonacci retracements with strong danger management, you possibly can limit potential losses and plan extra worthwhile trades. With practice and careful application, Fibonacci retracements can turn into a useful part of your buying and selling toolkit, serving to you trade efficiently in the long term.

Free Tools!

The 50% Fibonacci retracement degree is the place worth retraces half of its initial transfer. It’s not technically part of the Fibonacci sequence, however traders have adopted it as a result of price appears to respect the 50% stage very often throughout retracements. Routinely plots Fibonacci retracement levels with key zones, displaying critical ratios (0.382, zero.5, 0.618), price ranges, and zone strength (MT5). Instead of being extra prone to reverse on the higher levels (23.60% – 38.20%), worth instead has a much larger likelihood of reversing at the decrease ranges (61.80% – 78.60%).

- Alongside with the above factors, if the stoploss also coincides with the Fibonacci stage, I know the trade setup is properly aligned to all of the variables, and hence I would go in for a strong purchase.

- Popular extension ranges like 127.2%, 161.8%, and 261.8% assist merchants plan exits in trending markets 6 4.

- They assist traders anticipate attainable worth movements throughout tendencies or corrections, allowing them to set precise entry, exit, and stop-loss positions.

- The ratio of 1.618 is considered as the Golden Ratio, additionally referred to as the Phi.

- In the chart above, Delta Air Strains Inc. (DAL) sells off between $48 and $39 in two distinct waves.

This evaluation extends into the measurement of development and countertrend swings that carve proportional ranges, pullbacks, and reversals. A main indicator predicts potential worth strikes earlier than they happen. Examples embrace trading indicator RSI, Stochastic, or Fibonacci levels, which signal possible reversals or breakouts. Technical indicators allow you to time entry and exit points more effectively.

This is as a end result of buyers and traders take much more revenue off their trades during gradual actions, causing much deeper retracements to happen. A correction after a sharp price movement is much extra likely to end at the 38.20% or 23.60% retracement levels than the others. Fibonacci retracement levels are calculated by measuring the difference between a significant high and low level in a pattern. The Fibonacci ratios – corresponding to 23.6%, 38.2%, or 61.8% – are then utilized to this vary. It’s also essential to keep away from overtrading based mostly on these ranges alone. First, establish a significant swing excessive and swing low on your chart.